— PROJECT NAME

VirtualWealth

— ROLE

- UX/UI Manager

- Creative Director

— DURATION

- 9 months

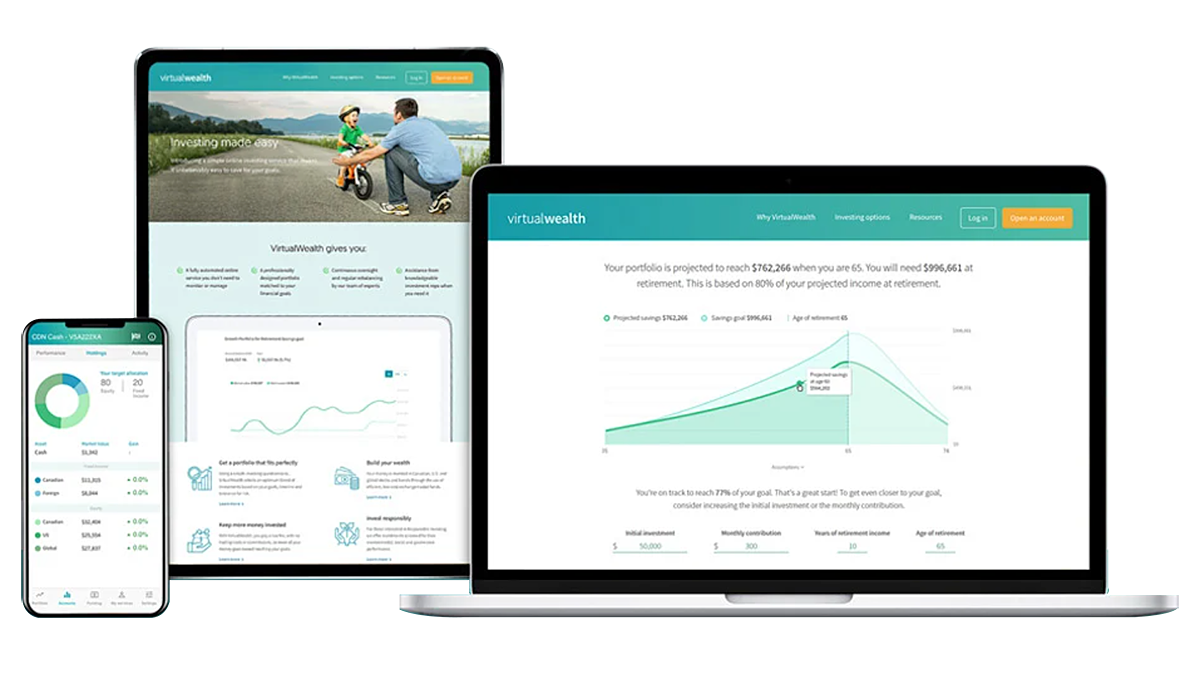

A robo-advisor platform that made investing accessible to everyone by eliminating the need for traditional financial advisors.

The solution introduced an automated, questionnaire-driven approach that transformed complex investment decisions into a simple “set it and forget it” experience across multiple platforms.

Situation

Traditional investing has always required ongoing advisor relationships, complex decision-making, and significant barriers to entry that excluded many potential investors. Clients faced intimidating processes, high fees, and the need for continuous portfolio management expertise. The market lacked a truly accessible automated solution that could handle everything from goal-setting to ongoing portfolio optimization without requiring advisor assistance.

Task

Design an elegant, simplified digital solution that would eliminate advisor dependency while streamlining the entire investing experience. The core challenge was translating complex investment concepts into an intuitive questionnaire-driven interface that could guide users from account opening through automated portfolio management across desktop and mobile platforms.

Action

Led end-to-end design from discovery to multi-platform launch, collaborating with users, stakeholders, engineering, QA, marketing, compliance, and executive teams while navigating tight timelines and working with new development teams and CMS platforms.

Discovery & Research I conducted discovery workshops with subject matter experts and advisors, analyzing existing workflows and user personas across different investor demographics. Through branding and co-design sessions with internal design and stakeholder, I established the foundation for a solution that would appeal to low-cost investors – both younger and established.

Design & Development Working with new developers and Adobe Experience Manager (AEM), I created responsive designs that functioned seamlessly across desktop, and mobile platforms. Using design tools for collaboration, I iteratively refined wireframes and prototypes through regular stakeholder and user feedback sessions. The key challenge was developing reusable components that could scale responsively while maintaining consistency across all platforms and screen sizes.

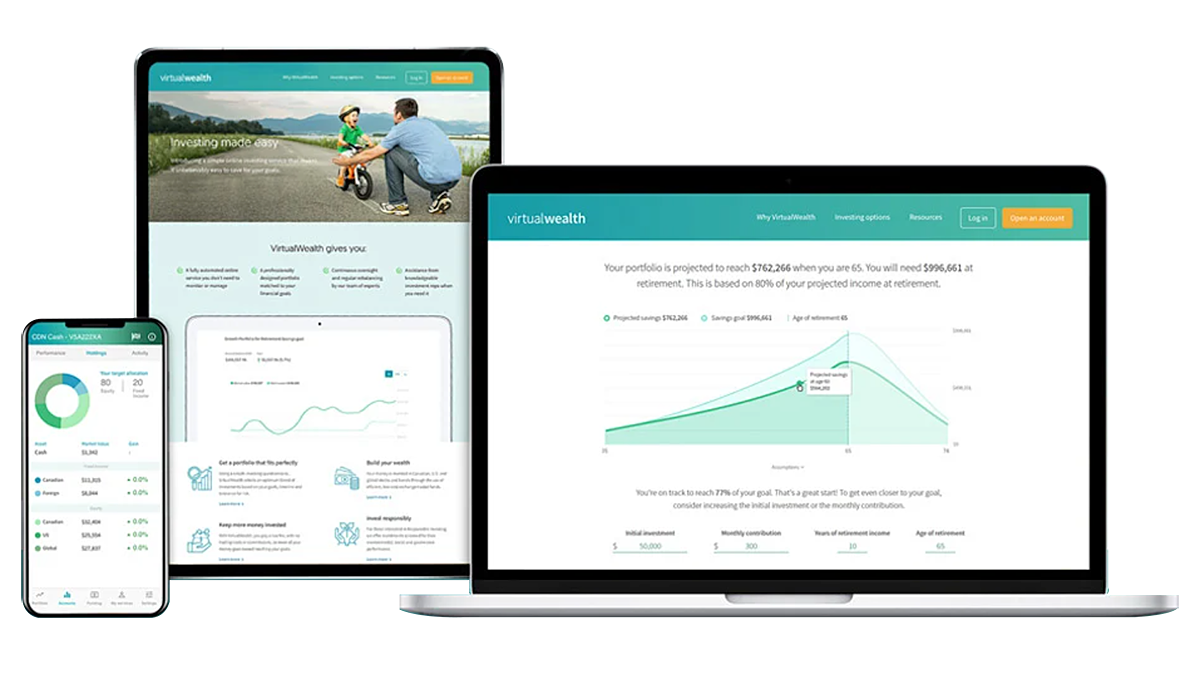

Strategic Solutions Delivered The questionnaire-driven onboarding became the heart of the experience, guiding users through goal-setting and risk assessment to recommend personalized portfolios. I designed a carefully curated colour palette that appealed to diverse demographics, since our audience was quite broad. Each page featured bold banner visuals with clear navigation, ensuring users always understood where they were in the process. The automated portfolio management system was a collaboration between our team and development, and handled ongoing monitoring, quarterly rebalancing, and optimization without user intervention.

Results

Launched Canada’s first multi-platform robo-advisor simultaneously across desktop, iOS, and Android, making Qtrade the first Canadian fintech to offer automated investing services on multiple platforms at launch.

Key learning: Learning to adapt to a new CRM tool while working with a new development team required significant trial & error and knowledge transfer between teams. Through this collaborative process, we successfully delivered across multiple platforms while establishing processes for continued support post-launch as well as future iterations.

Key achievements:

• Successfully delivered a cross-platform investment platform that drove 100% business expansion while establishing lasting design foundations

• Won a design award for VirtualWealth’s best website design

• Maintained a 4.5/5 star rating for the mobile app over 6 months post-launch

• Created an intuitive investment experience that made investing accessible and removed traditional barriers to entry, despite working with tight executive timelines and new development teams

The solution transformed investing from a complex, advisor-dependent process into an accessible self-serve “set it and forget it” experience that opened investment opportunities to entirely new market segments.